£0.00

Around 70 million dollars collected from sources with a high reputation. It is also available on Wall Street, courtesy of Bitwise. This is a unique strategic move to birth brand new trades in the crypto world.

“Elad Gil and Electric Capital”

The initiative raised 70 million dollars in Series B financing. Elad Gil and Electric capital were the primary members of this process. Bitwise is a company that hosted around 1.2 billion worth of  assets, just by managing them. The company released the announcement on the completion of the 70 million financings. This further placed the firm’s valuation at 500 million dollars. Besides Elad Gil and Electric Capital, other parties also participated in the funding round. The round comprised of S. Druckenmiller as well as Blackstone Nadeem Meghji.

assets, just by managing them. The company released the announcement on the completion of the 70 million financings. This further placed the firm’s valuation at 500 million dollars. Besides Elad Gil and Electric Capital, other parties also participated in the funding round. The round comprised of S. Druckenmiller as well as Blackstone Nadeem Meghji.

Profiting from the Crypto Expose

The introduction of Bitwise happened in the year 2017. It was the globe’s biggest CIF (Crypto-Index Fund). The company onboarded the CIF, which highly exposes several popular digital currencies. Not to mention in its liquidated, easier, and less expensive manner. This financing is most prominent with parties who require the crypto expose. As it does not necessarily pass via the decentralized or centralized exchange markets.

Earlier, the Chief Executive Officer to Bitwise, Hunter Horsley, stated something similar. He says that several traders will continually be investing in the crypto space. This will be in half a decade from now. And most traders may need to depend on identical funding specialists, procedures. At that time, the brokerage was for each asset category. Furthermore, the CEO said that the raised finances would be specifically channeled. This will divert to make more productive and diversified products for Bitwise.

The Defi Index Fund

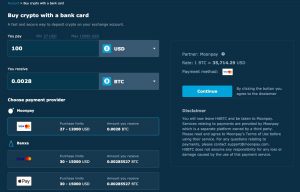

The firm has concrete links with companies specializing in funding advisory. This involves other family offices  cutting across the United States of America. Bitwise plans to develop a new platform where every party can look for solutions. Simpler crypto exposures for traders who take part in daily investments can also use it. Additionally, the four-year-old company plans to pilot the DIF (Defi Index Fund). This will be for traders with full accreditation. On top of that, the firm has made applications for the BTC (Bitcoin) – ETF. Although, the results are still pending due to the verdict by the American authority.

cutting across the United States of America. Bitwise plans to develop a new platform where every party can look for solutions. Simpler crypto exposures for traders who take part in daily investments can also use it. Additionally, the four-year-old company plans to pilot the DIF (Defi Index Fund). This will be for traders with full accreditation. On top of that, the firm has made applications for the BTC (Bitcoin) – ETF. Although, the results are still pending due to the verdict by the American authority.

As you may know, Bitwise introduced the Defi Index Fund early in 2021. Therefore, to enable institutional traders to trade with the newly created platform. Investors had the opportunity to profit from exposure to a bunch of tokens like ZRX and UMA. The environment was much enhanced to safeguard institutional investors’ investments. Besides the initiative enabling traders with accreditation to buy shares concerning DFI. The fund consisted of 9 tokens which were to be re-balanced every month. It’s on this platform that investors were also required to make investments of not below 25,000 dollars. It had a 2.5 expense ratio. This comprised of expenses like taxation, accounts, custodian fees, and management charges.

As the leading digital currency exchange platform, HitBTC has made the first move. They have announced the official introduction of HIT tokens. These tokens are with the exchange’s economic system. The token offers returns to the digital exchange investors and the key stakeholders.

Launched for Reliability

The exchange established in the year 2013. It still stands to be one of the critical giant investment houses in the crypto world. Since its existence in the market, HitBTC has a good record of being reliable.  It has made a mark on the overall growth in the crypto trade sector. Currently, the firm is offering good liquidated books cutting across the virtual assets. Still standing, HitBTC has worked smart to establish its token (HIT). This breaks the ground for the exchange’s ecosystem. Therefore, it helps contributors earn great returns.

It has made a mark on the overall growth in the crypto trade sector. Currently, the firm is offering good liquidated books cutting across the virtual assets. Still standing, HitBTC has worked smart to establish its token (HIT). This breaks the ground for the exchange’s ecosystem. Therefore, it helps contributors earn great returns.

Low Cost and Discounts

The HIT token has distinct characteristics. It comprises trade charges and discounts to a maximum of 45 %. Using the newly found token, clients will also experience less expensive trades. They will also receive extra benefits coming with the investment pairs. Furthermore, the highest distribution meant for the ERC20 allocation is 2 billion tokens.

Regarding  this allotment, the exchange announced 30 % closed in public. This equals at least 600 million. Currently, the HIT token won’t be available for pre-sale to private traders. All the 30 % of HIT tokens are out for sale in the open market while 20 % of the total. This will be equivalent to 400 million. It is set aside to serve the founding stakeholders. Apart from this, 50 % of the cumulative amounts are set aside for upgrading. This almost equals 1 billion.

this allotment, the exchange announced 30 % closed in public. This equals at least 600 million. Currently, the HIT token won’t be available for pre-sale to private traders. All the 30 % of HIT tokens are out for sale in the open market while 20 % of the total. This will be equivalent to 400 million. It is set aside to serve the founding stakeholders. Apart from this, 50 % of the cumulative amounts are set aside for upgrading. This almost equals 1 billion.

Additionally, HitBTC commented about repurchasing these tokens. It will use 20 % of the investment revenue sourced every month to repurchase HIT. After which, destroy (burn) the tokens each month. The token destruction will help minimize the rotating distribution of the HIT token.

The Whitepaper

HitBTC continues to offer services that are safe and reliable. This helps them to rise beyond the standard expectation. The exchange revealed that their dedication has been the pioneer in the investments. HitBTC also welcomes clients in the creation of an enhanced exchange platform. Besides, the firm delivered a detailed whitepaper comprising technical information of HIT tokens. They added, their exchange system can achieve on-average door-to-door latency. This will help them ease the process for investors.

Customers can invest and achieve great low-cost MD feeds via multiple upgrades. This will involve system procedures in the likes of FIX and Websockets. The exchange site also came out clearly on duplication and swiftness delivered.

Over the past couple of years, payment remedies have evolved quickly. The virtual wallets have been raising the bars for newbies. This is very in the whole monetary economic system.

Getting Rid of the Traditional Ecosystem

In truth, people have depended on the traditional financial ecosystem. Banking institutions that  process and complete different forms of payments locally and internationally. Various problems usually afflict the conventional model. For beginners, the availability of an intermediary lacks transparency. As execution needs more time, corrupt system hacks become more susceptible.

process and complete different forms of payments locally and internationally. Various problems usually afflict the conventional model. For beginners, the availability of an intermediary lacks transparency. As execution needs more time, corrupt system hacks become more susceptible.

Most people are already realizing. As there are available alternatives to pick from. Among them is Ripple Lab, a blockchain system firm located in San Francisco. Its discovery was in the enormous open door in small-scale business payments. There are many reasons why Ripple has its primary target in this market segment. Especially as there is a considerable growth source for expenditures.

Friction-less Mode to Transact Using Blockchain System

Introduction of brand-new payment system simplified talent acquisition. It also made distributions across borders simpler for SMEs. This has become so significant in the expansion of services to international markets. This is where Ripple now comes into the big display. It helps Small and Medium-sized Enterprises transact across the seas. The B2B (Business to Business) productive market in the cross-border payment(s). It has contributed to somewhat production in the past couple of months. This has become essential to both parties. This also includes Small and Medium-sized Enterprises and Ripple companies.

The Market Predictions

Furthermore, McKinsey, a consultancy company, predictions. It highlighted anticipated turnover from such a  market will rise by 9 percent. There are expectations that this will hit the 3 trillion dollars threshold by next year. However, not all people are aware of the income segmentation of Ripple. The company receives payments from places like the Asian Pacific. Now, the company mainly focuses on attending to the lowered value flows. Above all, it primarily consists of bills, wages, electronic commerce, and salary payments. This is because the great thirst for such enterprises hasn’t been catered for. Especially by the traditional financial methods. The new move is quickly becoming popular in the real world.

market will rise by 9 percent. There are expectations that this will hit the 3 trillion dollars threshold by next year. However, not all people are aware of the income segmentation of Ripple. The company receives payments from places like the Asian Pacific. Now, the company mainly focuses on attending to the lowered value flows. Above all, it primarily consists of bills, wages, electronic commerce, and salary payments. This is because the great thirst for such enterprises hasn’t been catered for. Especially by the traditional financial methods. The new move is quickly becoming popular in the real world.

Banks to Use XRP to Minimize Expenses

Ripple is additionally active in creating ODL paths. Therefore, this will be for new clients in Brazil and the UK. Several firms in these two regions successfully made various connections. This links to the corners of the Atlantic Ocean via Ripple blockchain technology. Moreover, this has allowed them to launch brand new systems for Business. And it will also include contributions from other countries. Additionally, the technology employed in the new system consists of a messaging protocol. These transactions will use rule-sets to achieve immediate confirmations around the globe.

The US Government retrieved two million dollars from hackers. This amount was ransom collected from the colonial pipeline. The DarkSide, a cyber-criminal team, was the one behind the attack. They had nearly siphoned the vast amounts of money from the government’s wallet.

Department of Justice Recovery Mission

In one of the press releases on Monday 7th June, a massive revelation came out. Moreover, it  indicated that the officials lost 63.7 BTC amounting to $2 million. This was the result of the rescue operation by the Ransomware team. It was in conjunction with the Digital Extortion Task Force. The Department of Justice formed this team. Both teams are responsible for combating threats and attacks by cybercriminals.

indicated that the officials lost 63.7 BTC amounting to $2 million. This was the result of the rescue operation by the Ransomware team. It was in conjunction with the Digital Extortion Task Force. The Department of Justice formed this team. Both teams are responsible for combating threats and attacks by cybercriminals.

In May 2021, the giant pipeline company faced a ransomware attack. The DarkSide hackers were responsible for this attack. The attacks crippled the firms’ regular operations, which stopped for nearly 7 days. This led to considerable public apprehension. It also caused insufficient gas supply at several stations. The gas firm submitted to the hacker demands for the ransom payment. The payment was of 4 million dollars by then, an amount equivalent to 75 BTC. After the price, the colonial pipeline made hasty decisions. They passed prompt info to the body responsible for law enforcement. Once reported, the Federal Bureau of Investigation (FBI) initiated a tracking process. After that, the FBI managed to track a payment transfer of at least 63.7 Bitcoins to a digital wallet. As part of their achievement, the FBI also retrieved private keys from the wallet address.

Not the First Attack

Lisa Monaco, the Deputy AG of the Department of Justice, made a statement. She stated that the DoJ was much dedicated to trapping the DarkSide group. She added the wholesome ransomware attack was to do disruption in its investigation. The announcement demonstrated the value of the timely report to the FBI. Lisa thanked the gas company for prompt notification. As they were able to learn the tactics of DarkSide to bring down the entire pipeline plant.

As per reports, forty entities had severely suffered in the dark hands of criminals. The group had managed to receive 90 million dollars in payment.

The American Government Plans to End Similar Attacks

From  a close observation, there seems to be a rising attack in the U.S based firms in the year 2021. For instance, the KIA, a company that deals with Motors, experienced a similar attack. It threatened the company to make a move and raise 600 Bitcoins. KIA intended to make demanded payments within a short period. JBS and SAM (Steamship Authority of Massachusetts) faced similar afflictions. The company issued a cattle slaughter suspension in the United States of America. But later on, it restored its regular activities.

a close observation, there seems to be a rising attack in the U.S based firms in the year 2021. For instance, the KIA, a company that deals with Motors, experienced a similar attack. It threatened the company to make a move and raise 600 Bitcoins. KIA intended to make demanded payments within a short period. JBS and SAM (Steamship Authority of Massachusetts) faced similar afflictions. The company issued a cattle slaughter suspension in the United States of America. But later on, it restored its regular activities.

In response, the American government has concrete plans to trace crypto operations. This was to mitigate additional ransomware attacks.