£0.00

Blockchain and tokenomics marked another level of development. Recently, Bolton Celtics released a partnership announcement with Socios. This partnership is to enhance the sports and entertainment sector.

The partnership will employ a digitized operation on Celtics. Therefore, contributing to the  overall business relation on the team’s web platform. This will give the website a top-notch priority on Celtics.com. It can be useful for advertisement through video reels, news, and many other options. Furthermore, Socios will have the capability to maximize its advantage from the partnership. Both parties hope to take this forward in the long run.

overall business relation on the team’s web platform. This will give the website a top-notch priority on Celtics.com. It can be useful for advertisement through video reels, news, and many other options. Furthermore, Socios will have the capability to maximize its advantage from the partnership. Both parties hope to take this forward in the long run.

Glad to Seek and Find Partnership

Concerning the international marketing operations, Celtics comprises huge fan traffic. It reinforces the entity across the continental realms. According to the Senior VP, Ted Dalton, they are much glad to seek this. He also adds this partnership will offer great value to fans. They are anticipating to have greater and deeper innovations and impact more fans. An achievement that will become prominent by the consistent partnership with Socios.

Celtics are icons, the globe’s prominent firm. This fact intensively delighted the Chief Executive Officer to Socios A.Dreyfus. In truth, the firm is going through a swift development of a realistic fan collaboration. They are also involved in increasing engagement in the global realms. We can say, it’s a partnership reflecting Socio’s economic expansion capabilities.

Towards the United States Marketplace

Socios.com has 40 distinct team groups. It cuts across the space of football, Formula One, sports, the MMA,  and the cricket industry. The overall partnership is merely a forward gear towards the USA market arena. Initially, NHL was the original team in America to come work closely with Socios.com. Later, another professional sports team known as Philadelphia 76ERS took its place. Socios.com is planning to launch a brand-new office in the Northern region of America as per their plans.

and the cricket industry. The overall partnership is merely a forward gear towards the USA market arena. Initially, NHL was the original team in America to come work closely with Socios.com. Later, another professional sports team known as Philadelphia 76ERS took its place. Socios.com is planning to launch a brand-new office in the Northern region of America as per their plans.

Passive to Active Fans

Apart from this, Socios.com aims at partnering with more entities in the coming days. Their mission aims at causing transitions particularly of passive fans to active fans. An activity that sounds important and innovative in the sports industry. According to them, they are visionary in extending networks. It involves the sporting entities in the global realms. To most sporting organizations, this is possible via tokenization programs on their platform. Tokens, collectibles, and the virtual assets minted will contribute here. As a result, more enhanced influential programs and returns economic system.

Chiliz was the main contributor to Socios.com’s performance. It currently records a total of at least 120 staff members. Besides its multilingual capabilities, it has also launched new points in Turkey.

In the past few years, the financial sector has recorded a remarkable progression. This is due to the creation of virtual currencies. A prominent figure in this is the CBDCS. They are also known as the Central Bank Digital Currencies.

The ideology has caused several Central banks to take interest. European Central bank (ECB), and the Bank of Japan, have developed interests in crypto. The European Central bank went ahead to  make a publication citing many threats. In the write-up, they talked about the association of failure to embark on the financial plan. The Spanish Socialist Party was also involved. They injected a proposal to encourage creation. Here a team is responsible for research. They are meant to examine the virtual Euro. The overall study was to help discover ways in which the virtual Euro currency may function. The party launched a zero law proposal. Therefore, this will help record feedback on the reduced usage of the traditional currency.

make a publication citing many threats. In the write-up, they talked about the association of failure to embark on the financial plan. The Spanish Socialist Party was also involved. They injected a proposal to encourage creation. Here a team is responsible for research. They are meant to examine the virtual Euro. The overall study was to help discover ways in which the virtual Euro currency may function. The party launched a zero law proposal. Therefore, this will help record feedback on the reduced usage of the traditional currency.

The Central Bank Digital Currencies

The CBDCS are the virtual crystal formats of current currencies. This includes Euro and the American dollar. These currencies may offer some real power to governments and centralized banks. Especially when it comes to causing stimuli to the overall economic system. Besides the ecosystem, the authority may extend to financial program execution. Such as the UBI (Universal Basic Income) as well as the possible collection of real-time taxes.

In theory, the Central Bank Digital Currencies grant the respective giant banks authority. With this, they will deliver  special payments directly to the public. The same can help to send it to their virtual wallets. This is useful, especially when the economic depression strikes. In recent reports, the are grown speculations citing liquid cash injection. It gets created with virtual money. This has a certain expiration. Its utilization is when buying several items. A nice example is when you give close thought to payments linked to welfare programs. This system’s utilization is on basic items such as food, clothes, and shelter. As things unfold, the Central Bank Digital Currencies may cause a reduction. It will certainly cause a reduction in the roles of banks in the private financial sector.

special payments directly to the public. The same can help to send it to their virtual wallets. This is useful, especially when the economic depression strikes. In recent reports, the are grown speculations citing liquid cash injection. It gets created with virtual money. This has a certain expiration. Its utilization is when buying several items. A nice example is when you give close thought to payments linked to welfare programs. This system’s utilization is on basic items such as food, clothes, and shelter. As things unfold, the Central Bank Digital Currencies may cause a reduction. It will certainly cause a reduction in the roles of banks in the private financial sector.

Privacy Freedom Concerns and Tracking

There is a great worry linked to private freedom and financial surveillance. This will act the moment the Central Bank Digital Currencies program kicks off. The governments may exercise greater power. This can make investors more uncomfortable when managing their digital assets. The capacity to give out virtual payments to the public comes with possibilities. Several individuals have gone ahead to question these decisions. They want to know whether the governments will make financial restrictions. And to whom will it be applicable among its population. This will also shed light on the direct implementation of tracking systems. As they are very useful to monitor the economic patterns of the public at large.

The financial threats have been evolving around attractive labels and pop-ups. Such as ‘get richer quick,’ ‘become a financial guru in easy steps’ among other spiced formats. This has been loud. Especially on social media platforms and via direct emails. There were bold and highlighted headings. You were to make moves and make huger investments. That too in an unrealistic time frame.

Scammers on the Next Level

Besides the trial currencies, scammers have gone to the next level. They have also started duping active and prospective investors in the crypto world. Various digital currencies like Bitcoin,  Ethereum, Dogecoin, and Litecoin have also afflicted. That’s why several financial regulators are coming in. Which is to restrict some investments in the crypto space. A report came out recently. It showed an incredible explosion in the digital world of cryptos. This is causing scamming groups to come out pretending to be multi-billionaires. Due to these investments. Some have gone beyond pretending to be Tesla or Elon Musk.

Ethereum, Dogecoin, and Litecoin have also afflicted. That’s why several financial regulators are coming in. Which is to restrict some investments in the crypto space. A report came out recently. It showed an incredible explosion in the digital world of cryptos. This is causing scamming groups to come out pretending to be multi-billionaires. Due to these investments. Some have gone beyond pretending to be Tesla or Elon Musk.

According to Pinsent Masons, some of their findings revealed fraudulent programs. These programs have even doubled in the past year alone. Their conclusion further told that at least 3,500 scams came up before the Action Fraud. After that, these cases skyrocketed to at least seven thousand by the third month. This could have been worse. Especially when individuals spent their great time in their homes. And as a result, they started investing as they sought financial profits.

Safeguard your Future Investment today

The Action Fraud in the United Kingdom provided some helpful tips. All investors were to safeguard their investments.

First, investors shouldn’t make assumptions regarding several adverts popping up. There are many beautiful websites and social media platforms. These try to highlight such projects. It also came to our notice that scammers can use prominent personalities. They can even use brands to dupe individuals with their “legit” adverts.

In  addition, every investor should not rush into making decisions. This comes especially when fraudulent organizations tend to pressure people to make investments. Any genuine bank won’t display ‘greed’ programs and investments for swift rewards.

addition, every investor should not rush into making decisions. This comes especially when fraudulent organizations tend to pressure people to make investments. Any genuine bank won’t display ‘greed’ programs and investments for swift rewards.

People should also try to dodge spiced investment offerings. Especially investments made over cold communication. Thinking about undergoing an investment program? Simply acquire some professional advice after reviewing the financial entity first.

Finally, develop a cautious approach towards the crypto space. Of course, you may have come across some famous folks. They extol the values of the digital currency property investments to their disciples. Especially on social platforms. There are legit methods of carrying out investments on property via virtual currencies. It is vital to be aware of cite threats. These are mainly associated with property investments via digital coins. Avoid the ideology of untold wealthy folks programs which happen in a matter of few hours.

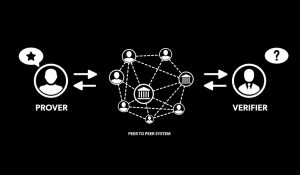

Ever come across a ZKP abbreviation? In short, it’s the Zero-Knowledge Proof. This is simply a protocol. It is useful for entities that want to safeguard their secret details. It is merely factual without necessarily letting the secret out of the bag.

ZKP Authentication and Application

This is a scenario that involves a prover and a verifier. The protocol may be into distinct aspects. That is, interactive or non-interactive. A good instance is when the ‘verifier’ takes to the ‘prover’ an H (hash).  In this case, the proving side proofs that the other party has secretive information. It has the capability to hash to H.

In this case, the proving side proofs that the other party has secretive information. It has the capability to hash to H.

The proving party produces a ZKP caring a prove that the verifying party has its data that can hash. In fact, no information revelation made to the verifying party. This will be regarding the information thereof.

Authentication Protocol

In the authenticity process, the proving agent makes proof. This drives the verifying agent towards the possession of a secret identity. Think of a case where the proving side has RSA or EC (Asymmetric Key Pairs). They can make use of the privatized key to issue a response. This will be a given problem sent as proof with the privatized key. In all cases, the privatized key is non-revealing. Although the verifying party might have proof of possession of the privatized. The ‘prover’ with all correctness executes several computations. Therefore, information transfer is not without making any revelation concerning the encapsulated secrets.

How Does the Blockchain Technology Relate with ZKP?

Back to the crypto world brief, we have a blockchain system. It incorporates a distinct listing of records. These  records are usually cumulatively managed by many entities globally. These entities possess lists with blockchain. This grants all involved entities in viewing entire transactions in the network. Therefore, there is no provision of private information or anonymity. The ZKP grants privacy, especially when dealing with transactions that require confidentiality. Therefore, offering a method to prove that transactions made with clarity. Thus, the party’s secret data is not revealed. Such data evolves around the amounts and addresses used in the entire transaction.

records are usually cumulatively managed by many entities globally. These entities possess lists with blockchain. This grants all involved entities in viewing entire transactions in the network. Therefore, there is no provision of private information or anonymity. The ZKP grants privacy, especially when dealing with transactions that require confidentiality. Therefore, offering a method to prove that transactions made with clarity. Thus, the party’s secret data is not revealed. Such data evolves around the amounts and addresses used in the entire transaction.

Where is ZKP Applied?

The Zero Knowledge Proof applies in several aspects. Especially when dealing with information that needs encapsulation. One of the areas worth applying the ZKP framework is when preserving confidentiality. Data involved in the whole setup goes through encryption. Any proof posted for proves is then done with correctness. Another area where the ZKP application is to optimize the overall performance. This helps for apps supplied in the blockchain system. In this case, the app codes implementation is off-chain. It can also happen through a given computer. This might be available in the blockchain system.